Delhi Car Insurance

Check Vehicle Owner Details

Find Nearest RTO Office

Find RTO Office by State

Check RTO details state wise

RTO Telangana

RTO Andhra Pradesh

RTO Arunachal Pradesh

RTO Karnataka

RTO Madhya Pradesh

RTO Nagaland

RTO Mizoram

RTO West Bengal

RTO Tripura

RTO Maharashtra

RTO Kerala

RTO Meghalaya

RTO Punjab

RTO Haryana

RTO Himachal Pradesh

RTO Odisha

RTO Manipur

RTO Tamil Nadu

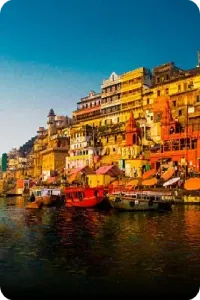

RTO Uttar Pradesh

RTO Gujarat

RTO Goa

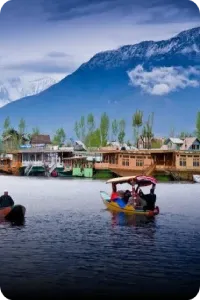

RTO Jammu & Kashmir

RTO Jharkhand

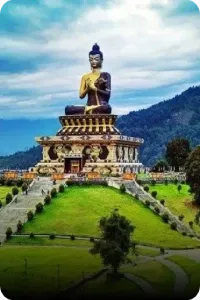

RTO Sikkim

RTO Chhattisgarh

RTO Delhi

RTO Uttarakhand

RTO Bihar

Car Insurance in Delhi

Delhi, the capital of India, is home to a lot of cultures, different kinds of people, and famous places to visit. Having a car in Delhi can be helpful to get around, but it can also be tough because there is a lot of traffic, the roads are crowded, and it's hard to find a place to park.

As a car owner in Delhi, you must have comprehensive insurance coverage for your vehicle. Accidents are common on the city's roads and having insurance can protect you from financial losses due to damage or theft.

The importance of car insurance in Delhi must be considered with care. With various insurance providers and policies available in the city, it is important to research and choose the right coverage that meets your needs and budget.

Best Car Insurance Rates in Delhi

The premiums offered by insurance companies are the main criterion for ranking the best auto insurance quotes in Delhi. The finest auto insurance rate estimates are provided only for informational purposes, and the consumer is responsible for making the final choice based on their specific needs.

1. National Insurance Company Limited (NICL)

NICL offers several car insurance plans that cover various scenarios. Here is some information on the pricing, inclusions, and claims process for NICL's car insurance plans in Delhi:

Pricing: The cost of NICL's car insurance plans varies based on several factors, including

the make and model of your car, your location, your age and driving history, and the level of coverage you choose.

Inclusions: NICL's car insurance plans typically include coverage for damage to your car due to accidents, theft, fire, natural disasters, and other unforeseen events.

Claims process: You must provide your policy details, the details of the incident, and any relevant documents such as the FIR, driving license, and vehicle registration certificate.

2. Reliance

Automobile insurance is only one of the many services that Reliance provides. Below are details of Reliance's automobile insurance policies in Delhi, including premiums, coverage details, and how to file a claim.

Pricing: Your car's model and year, your geographic area, your age and driving record, and the policy options you select all affect how much you pay for auto insurance via Reliance.

Inclusions: Damage to your vehicle due to an accident, theft, fire, or natural catastrophe are all commonly covered by the comprehensive policies offered by Reliance Insurance.

Claims process: To file a claim, you must supply information about your policy, the occurrence, and supporting papers such as the police report, driver's license, and car registration certificate.

3. Oriental Insurance Company Limited (OICL)

OICL offers several car insurance plans that cover various scenarios. Here is some information on the pricing, inclusions, and claims process for OICL's car insurance plans in Delhi:

Pricing: The cost of OICL's car insurance plans varies based on several factors, including the make and model of your car, your location, your age and driving history, and the level of coverage you choose.

Inclusions: OICL's car insurance plans typically include coverage for damage to your car due to accidents, theft, fire, natural disasters, and other unforeseen events.

Claims process: To file a claim with OICL, you can either visit their website and file a claim online or call their toll-free number. You will need to provide your policy details, the details of the incident, and any relevant documents such as the FIR, driving license, and vehicle registration certificate. Once the claim is approved, OICL will arrange for the repairs and settlement of the amount.

Tips to Get Car Insurance in Delhi with a Low Rate

Keeping these tips in mind will help you find good rates for your car insurance.

● Compare quotes: To get the greatest vehicle insurance rate, compare quotes from several suppliers. Numerous websites compare Delhi auto insurance costs. Always compare at least three insurance companies' pricing.

● Choose the correct coverage: Car insurance premiums vary by coverage. Choose a policy that covers what you need without overpaying. Obtain a policy that offers sufficient range at an affordable price.

● No-claim bonus: A policyholder receives a discount if no claims were filed the previous year. NCB discounts vary from 20% to 50%, depending on claim-free years. Check each insurer's NCB discount while comparing rates.

● Deductibles: The policyholder pays the deductible before the insurance company pays the claim. The policyholder's premium may be lower if they choose a higher deductible, but they'll have to pay more out of pocket for accidents.

How to File a Car Insurance Claim

It is essential to be familiar with filing a claim for auto insurance in an unanticipated event, such as a collision or theft. The following are the steps involved in filing a car insurance reimbursement claim:

Notify the insurance company straight away. You must contact your insurance provider immediately following an accident or other occurrence. Call them at their customer care number or utilize their website or mobile app to start filing a claim.

Provide the necessary details: You will need to provide details such as the date and time of the incident, the location, the nature of the incident, and the contact details of any witnesses.

Submit the required documents: You must submit the necessary documents, such as the FIR, vehicle registration certificate, driving license, and insurance policy document.

Get an estimate for repair or replacement: You will need to get an estimate of the repair or replacement costs from an authorized garage or dealer.

Wait for the claim to be processed: The insurance company will process your claim and provide the reimbursement amount per the policy terms and conditions.

What You Need to Apply for Car Insurance in Delhi

To submit a claim for auto insurance in Delhi, you must present the insurance company with several documents, including your vehicle registration certificate, driver's license, and some other form of identification.

Because the necessary paperwork could differ from one insurance provider to the next, double-checking this information with the business in advance is important.

Documents Required

While applying for auto insurance, your expected documentation might differ based on the insurance provider and the policy you seek to obtain. Usually, you will need to supply the following documents:

● Vehicle registration certificate (RC) or copy of the same

● Driving license of the vehicle owner

● A valid ID proof (such as an Aadhaar card, voter ID, passport, etc.)

● Vehicle purchase invoice (for a new car) or sale deed (for a used car)

● Previous insurance policy documents (if applicable)

● Pollution Under Control (PUC) certificate

● Vehicle inspection report (for certain types of policies)

● Additional documents (such as No Claim Bonus (NCB) certificate, if applicable)

How to Register Vehicle Offline & Online in Delhi

The registration of vehicles is crucial to confirm the legality of driving and add legitimacy to the whole operation on the road. Here is a step-by-step procedure for vehicle registration online and offline:

Offline

Online

Visit the nearest Regional Transport Office

Visit the nearest Regional Transport Office (RTO) or a designated vehicle registration centre

Collect application form

Collect the required application form for vehicle registration

Fill out all necessary information

Fill out the application form accurately with all necessary information, such as vehicle number, model, owner's details, etc

Attach documents

Attach the supporting documents, such as proof of identity, proof of address, vehicle invoice, insurance certificate, pollution under control (PUC) certificate, and chassis and engine number

Submit application to the designated authority

Submit the completed application form with supporting documents to the designated authority

Pay application fees

Pay the applicable registration fees and taxes at the designated counter

Authority will issue a RC

Upon verification of the documents and payment, the authority will issue a registration number and a registration certificate (RC) for your vehicle

Put registration number plate

Use the registration number plate on your vehicle as per the regulations given by the authority

Visit the Online Website

Visit the official website of the Ministry of Road Transport and Highways (MoRTH) or the respective state transport department's website.

Go to Online Vehicle Registration Section

Find and go to the Vehicle Ownership Section

Register/Log in

Register for an account or log in with your existing credentials.

Fill out the online application form

Fill out the online application form for vehicle registration with accurate details.

Upload scanned copies

Upload the scanned copies of the required documents, including proof of identity, proof of address, vehicle invoice, insurance certificate, PUC certificate, and chassis and engine number.

Pay Applicable Fees

Pay the applicable registration fees and taxes at the designated counter.

Submit application and documents

Make the online payment for registration fees and taxes using the available payment options.

Authority will issue a RC

After verification of the submitted documents and payment, the authority will issue a registration number and a digital registration certificate (RC) for your vehicle

Get digital RC

Download and print the digital RC from the online portal

Put registration number plate

Use the registration number plate on your vehicle as per the regulations specified by the authority

Why should you Prefer Park+ to Check RTO Details?

How to Transfer Vehicle Ownership Online and Offline in Delhi

Transferring vehicle ownership is a crucial process that involves legally transferring the rights and responsibilities of owning a vehicle from one individual or entity to another. Here is a step-by-step procedure for transferring vehicle ownership online and offline:

Offline

Online

Visit the nearest Regional Transport Office

Visit the nearest Regional Transport Office (RTO) or designated vehicle registration centre to get the vehicle ownership transfer application

Fill all necessary details

Fill out the application form with all necessary details, including the seller's and buyer's information, vehicle details, and transferor's consent

Sign the application

Both the seller (transferor) and the buyer (transferee) must sign the application form along with two witnesses

Attach the supporting documents

1. Attach the supporting documents required for ownership transfer, such as: 1. Original registration certificate (RC) of the vehicle. 2. Proof of identity and address of both the seller and the buyer. 3. Sale agreement or deed of transfer (if applicable). 4. No Objection Certificate (NOC) from the financier (if the vehicle is under a loan). 5. Valid insurance certificate. 6. Pollution under control (PUC) certificate.

Submit application to the designated authority

Submit the completed application form with supporting documents to the designated authority at the RTO or vehicle registration centre.

Transfer fee and road tax

Pay the applicable transfer fee and road tax (if any) at the designated counter

Authority will issue a new RC

After verifying the documents and payment, the authority will update the ownership details in the vehicle's registration certificate (RC) and issue a new RC in the buyer's name

Receive updated RC

The buyer will receive the updated RC, and the seller will retain a copy of the sale agreement or deed of transfer for their records

Visit the Official Website

Visit the official website of the Ministry of Road Transport and Highways (MoRTH) or the respective state transport department's

Got to Vehicle Ownership Transfer

Open the online vehicle ownership transfer portal

Register/Log in

Register for an account or log in with your existing credentials.

Fill Out the Online Application Form

Fill out the online application form for vehicle ownership transfer with accurate details, including seller's and buyer's information, vehicle details, and transferor's consent.

Upload Scanned Copies

1. Original registration certificate (RC) of the vehicle. 2. Proof of identity and address of both the seller and the buyer. 3. Sale agreement or deed of transfer (if applicable). 4. No Objection Certificate (NOC) from the financier (if the vehicle is under a loan). 5. Valid insurance certificate. 6. Pollution under control (PUC) certificate.

Transfer Fee and Road Tax

Make the online payment for the transfer fee and road tax (if any) using the available payment options.

Submit Application & Documents

Once the payment is processed, submit the application form and documents through the online portal.

Receive Updated RC

After verification of the submitted documents and payment, the authority will update the ownership details in the vehicle's registration certificate (RC) electronically.

Authority will issue a new RC

After verification of the submitted documents and payment, the authority will update the ownership details in the vehicle's registration certificate (RC) electronically

Receive confirmation

Both the seller and the buyer will receive a confirmation of the ownership transfer through the online portal

Get Digital RC

The buyer can download and print the updated RC from the online portal for their records

Common fees structure

Driving License

| Documents | Prices |

|---|---|

| Application Fee | ₹200 to ₹500 (varies by state) |

| Learner's License Test Fee | ₹30 to ₹150 (varies by state) |

| Driving Test Fee | ₹50 to ₹300 (varies by state) |

| Renewal Fee: | ₹200 to ₹500 (varies by state) |

| Duplicate DL Fee | ₹200 to ₹400 (varies by state) |

Vehicle Registration Certificate (RC):

| Documents | Prices |

|---|---|

| Registration Fee | ₹600 to ₹1,500 (varies by state) |

| Smart Card Fee | ₹200 to ₹500 (varies by state) |

| Hypothecation/Endorsement Fee | ₹100 to ₹300 (varies by state) |

| Transfer of Ownership Fee | ₹300 to ₹1,000 (varies by state) |

| Duplicate RC Fee | ₹200 to ₹400 (varies by state) |

Fitness Certificate:

| Documents | Prices |

|---|---|

| Fitness Test Fee | ₹200 to ₹600 (varies by vehicle type) |

| Fitness Certificate Fee | ₹300 to ₹800 (varies by vehicle type) |

Permit Fees:

| Documents | Prices |

|---|---|

| Temporary Permit | ₹50 to ₹200 (varies by state) |

| National Permit | ₹500 to ₹2,000 (varies by state and vehicle type) |

| State Permit | ₹200 to ₹800 (varies by state and vehicle type) |

Road Tax:

| Documents | Prices |

|---|---|

| Entry Tax | ₹200 to ₹1,000 (varies by state and vehicle type) |

| Road Tax | 4% to 15% of the vehicle's ex-showroom price (varies by state and vehicle type) |

| Green Tax | ₹500 to ₹2,000 (varies by state and vehicle type) |

Explore

What Services does RTO Provide?

The Regional Transport Office (RTO) provides a range of services related to vehicle registration, driver licensing, and enforcement of transportation laws. Some of the key services offered by RTOs include:

1

RTO facilitate the registration of new vehicles and the renewal of registration for existing vehicles.

2

Provide driver's licenses and other permits needed to drive various types of vehicles.

3

Vehicle Fitness Certification to assess vehicle roadworthiness and safety standards, issuing fitness certificates accordingly.

4

Issuance of Permits for commercial vehicles such as taxis, buses, trucks, and auto-rickshaws, allowing them to operate legally.

5

Collect Road Taxes and other fees related to vehicle registration and licensing.

6

Enforcement of Traffic Rules, such as monitoring vehicle emissions and conducting vehicle inspections.

7

RTOs maintain databases of registered vehicles, drivers, and other relevant information to ensure transparency and accountability in transportation management.

Delhi Car Insurance FAQs

1) Why do we need auto insurance?

Auto insurance is crucial for safeguarding your financial interests in the event of unexpected incidents such as accidents, theft, or natural disasters that may cause damage or loss to your car.

2) What does third-party liability coverage in car insurance mean?

Auto insurance includes a type of coverage called third-party liability coverage, which provides protection if you cause damage or injury to someone else or their property while driving your car.

3) What does comprehensive auto insurance mean?

Comprehensive auto insurance protects your vehicle from financial loss if it is damaged due to an accident, theft, natural disaster, fire, or any other unanticipated occurrence.

4) In auto insurance, what is a No Claim Bonus (NCB)?

A no-claims bonus, or NCB, is a reward that is granted to policyholders for going the duration of the policy without filing any claims. While the insurance is being renewed, the customer can receive a reduction in the total amount of the premium.

5) How long does auto insurance coverage typically last?

The duration of coverage for auto insurance is typically one year, at the end of which it must be renewed. Longer-term insurance plans, such as those lasting two or three years, are provided by certain insurance firms.

6) Can I transfer the ownership of my car insurance policy to someone else?

When you sell your car to someone else, you can transfer your auto insurance coverage to the new owner. You must notify your insurance provider about the change in ownership and give the relevant documentation, such as the car registration certificate, the former owner's NOC, and the vehicle's sale deed.

7) What types of coverage are available in auto insurance?

Auto insurance coverage normally includes liability coverage, collision coverage, and comprehensive coverage. Some policies may also offer additional options such as roadside service and rental car coverage.

8) Is auto insurance mandatory in India?

Yes, as per the Motor Vehicles Act of 1988, all vehicles in India must have auto insurance.