In today’s fast-paced world, waiting in long toll queues can be a major inconvenience. Enter Axis Bank FASTag—a simple, efficient, and cashless solution for toll payments. Whether you’re a daily commuter or an occasional road tripper, FASTag ensures seamless travel on national highways. This comprehensive guide will walk you through everything you need to know about buying, recharging, and managing your Axis Bank FASTag.

Axis Bank FASTag is an electronic toll collection system that uses RFID (Radio Frequency Identification) technology. It’s a small, reusable tag that you stick to your vehicle’s windshield. When you pass through a toll plaza, the toll amount is automatically deducted from your linked Axis Bank account or prepaid wallet.

Cashless Transactions: No need to carry cash for toll payments.

Real-Time Alerts: Receive SMS notifications for every toll transaction.

Easy Recharge: Top up your FASTag balance online anytime, anywhere.

Wide Acceptance: Accepted at all national highway toll plazas across India.

FASTag is no longer just a convenience—it’s a necessity. Here’s why:

Saves Time: Avoid long queues at toll plazas and enjoy faster passage.

Eco-Friendly: Reduces fuel consumption and emissions by minimizing waiting time.

Track Expenses: Get detailed FASTag transaction history for better expense management.

Mandatory Compliance: The Indian government has made FASTag mandatory for all vehicles to reduce traffic congestion and promote digital payments.

Must Read --> What is Axis Bank FASTag?

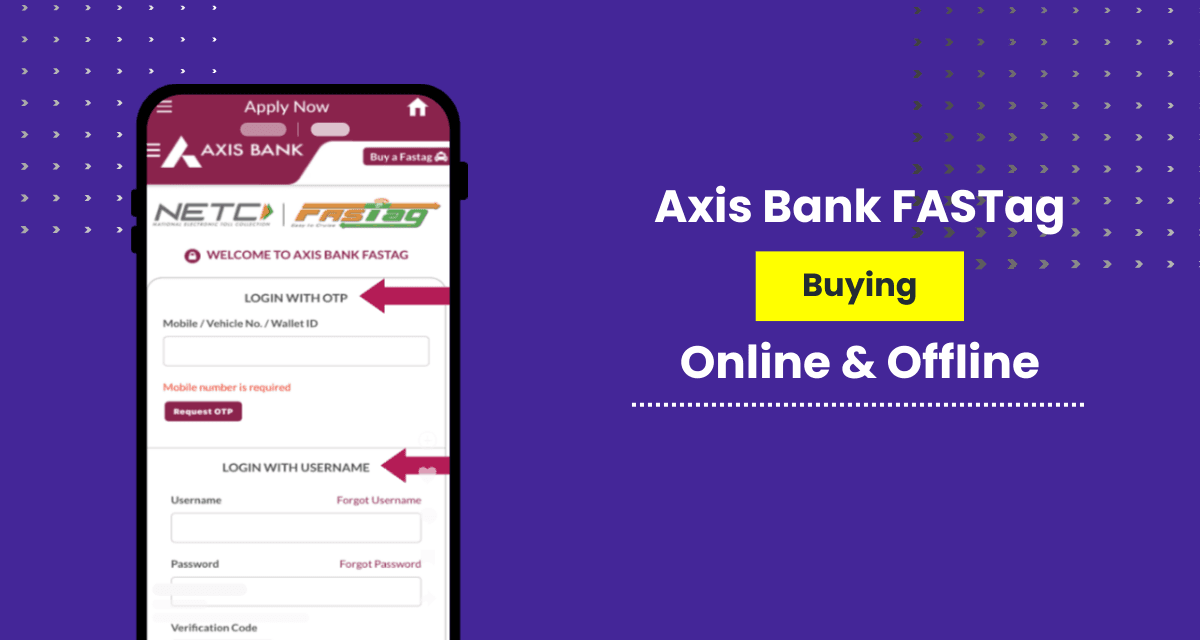

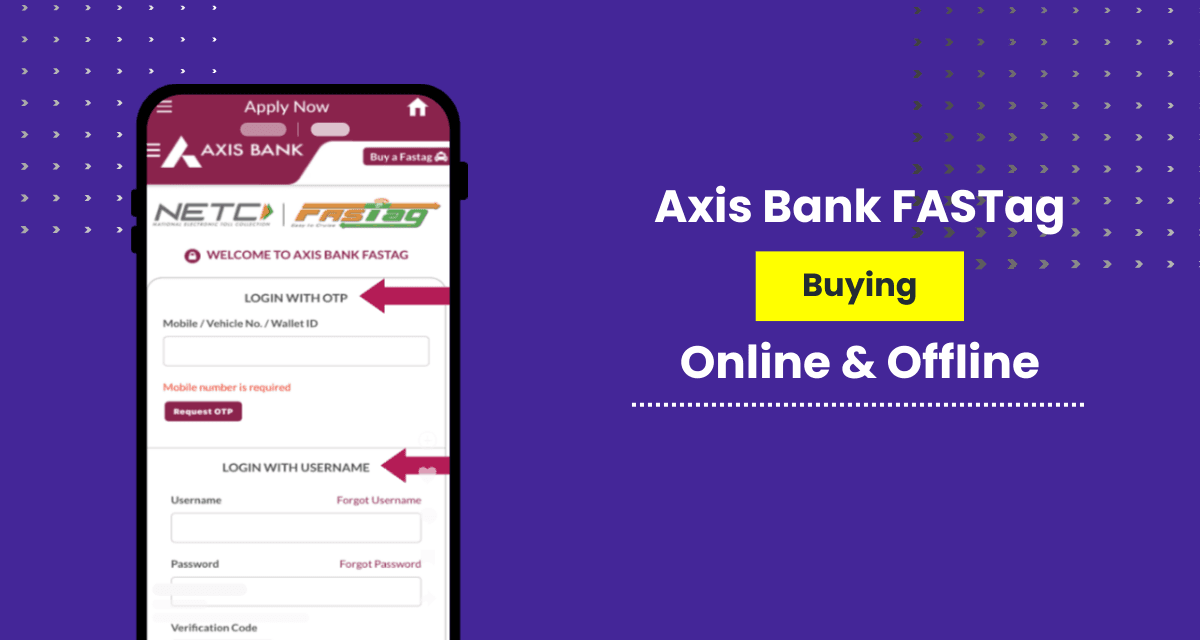

Axis Bank offers multiple convenient ways to purchase FASTag, both online and offline. Let’s explore each method in detail.

Your FASTag will be delivered to your registered address within a few days.

Your FASTag will be delivered to your doorstep.

Visit your nearest Axis Bank branch.

Fill out the FASTag application form.

Submit the required documents, including your vehicle’s RC and KYC proof.

Pay the applicable charges (issuance fee and security deposit).

Receive your FASTag instantly or wait for delivery.

Visit an Axis Bank Point of Sale (POS) at any toll plaza.

Provide your vehicle details and submit the necessary documents.

Pay the charges and receive your FASTag on the spot.

To apply for an Axis Bank FASTag, you’ll need the following documents:

Vehicle Registration Certificate (RC)

Passport-size photograph of the vehicle owner

KYC Documents:

Company PAN Card

Certificate of Incorporation

Address Proof of the company

Authorized Signatory’s KYC Documents

Here’s a breakdown of the costs involved in purchasing an Axis Bank FASTag:

One-Time Issuance Fee: ₹100 (approx.)

Security Deposit: ₹200–500 (refundable upon cancellation)

Minimum Balance: Required for activation and usage (varies based on vehicle type).

Convenience: No need to carry cash or wait in long queues.

Time-Saving: Enjoy faster passage through toll plazas.

Flexible Recharge Options: Recharge online via multiple platforms.

Wide Acceptance: Accepted at all national highway toll plazas.

Real-Time Tracking: Monitor your toll expenses with SMS alerts.

Axis Bank FASTag is a game-changer for hassle-free toll payments. With multiple purchase options, easy recharging, and wide acceptance, it’s the perfect companion for every vehicle owner. Whether you choose to buy it online or offline, the process is simple and quick.

So, why wait? Get your Axis Bank FASTag today and enjoy seamless, cashless travel on India’s highways. Say goodbye to toll queues and hello to stress-free journeys!

Bookmark this guide for quick access to all the FASTag info you’ll ever need!