How to Check Axis Bank FASTag Balance?

How to Check Axis Bank FASTag Balance?

Axis FASTag is a compact reloadable card and enables automatic deduction of tolls from the respective bank account linked with the FASTag on the vehicle as one drives through the toll plazas on national highways.

The Axis Bank FASTag online service facilitates cashless transactions, helps do a FASTag balance check for Axis Bank online, and helps avoid the long queues from forming at the toll plazas. This guide dives into Axis Bank FASTag balance check methods that keep you rolling.

More importantly, it does not require the FASTag holder to travel to the bank branch for such small services. So if you are wondering how to check FASTag balance Axis Bank, the online portal offers a seamless solution. This FASTag service ensures a smooth and efficient toll payment experience.

Before we dive into how to check Axis Bank FASTag balance, let’s talk about why it’s a big deal.

FASTag isn’t just a gadget—it’s your key to cashless travel across India’s 1,200+ toll plazas. In 2024, NHAI data shows that over 90% of toll payments were FASTag-powered, cutting fuel use by 15% and CO2 emissions by 20%. But if your balance drops too low, you’re risking double toll fees or a traffic jam.

Knowing how to know FASTag balance Axis keeps you ahead, dodging penalties and keeping your journey epic.

Axis Bank offers a toolbox of options to figure out how to check FASTag balance Axis Bank blending digital flair with offline ease. Here’s the rundown:

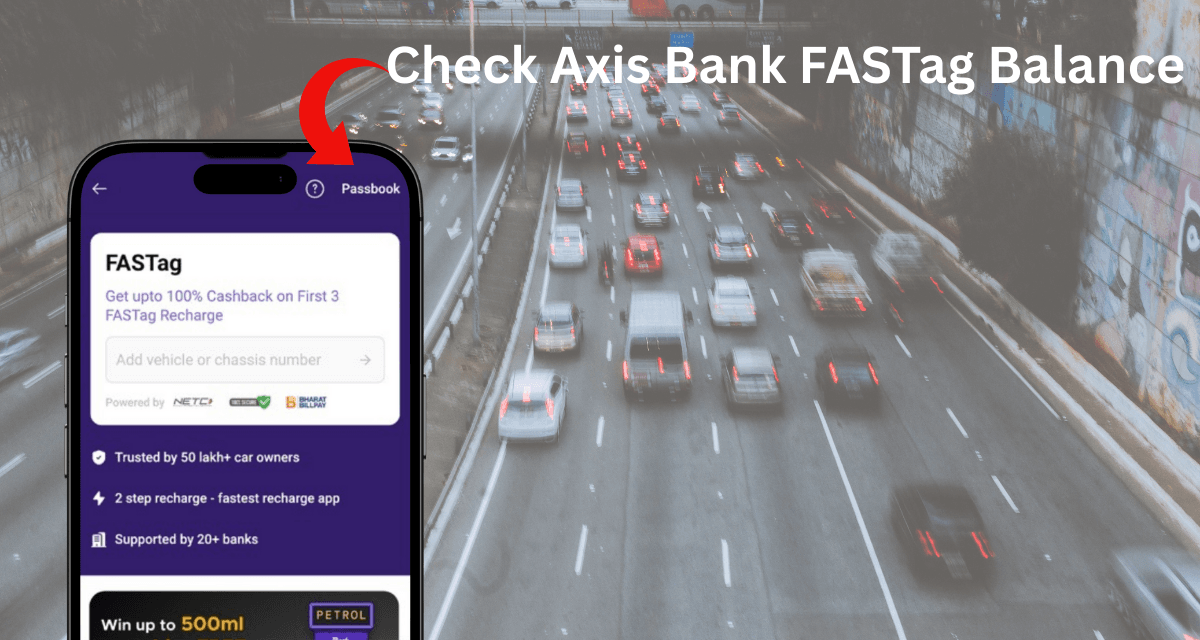

Love convenience? The easiest way is the Park+ app, or if you prefer a local way, go for the Park+ website, a slick way to tackle how to check FASTag balance Axis Bank.

How to Do It: Install Park+ from your app store or directly access it through the website, log in with your Axis-registered number, and check your balance under the FASTag tab.

Why It’s Cool: It’s user-friendly and doubles as a FASTag recharge by vehicle number, perfect for multitaskers as well as ideal for managing your new FASTag account.

The other alternative is Axis Mobile App is your ticket to how to check Axis Bank FASTag balance. With 250+ services, it’s a powerhouse.

How to Do It: Grab the app from Google Play or the App Store, log in, hit the “FASTag” tab, and select “Check Balance.” Your funds will appear instantly.

Why It Rocks: Real-time updates and recharge options—70% of Axis FASTag users love it, per 2024 stats.

No smartphone? No problem! Axis Bank’s missed call trick simplifies how to know FASTag balance Axis.

How to Do It: Dial 7287 999 990 from your registered number, let it ring once, and hang up. An SMS with your balance lands in seconds.

Why It’s Cool: It's Free, 24/7, and data-free—15% of users swear by this method.

Curious about how to check FASTag balance Axis Bank mid-trip? The toll plaza’s got you.

How to Do It: Roll through with your FASTag, and the screen flashes your remaining balance post-deduction.

Why It Works: Instant and effortless—80% of toll plazas now show this, says NHAI.

Axis Bank’s SMS alerts make how to know FASTag balance Axis a no-brainer.

How to Do It: After each toll payment, check the SMS on your registered number for your updated balance.

Why It’s Handy: Zero effort—95% of users get these alerts, per 2024 data.

Sometimes, you just want to talk it out to learn how to check Axis Bank FASTag balance. Axis Bank’s helpline delivers.

How to Do It: Call 1800 419 8585, follow the IVR, and pick the balance option. The representative will help you with the FASTag balance details.

Why It’s Great: Toll-free and 24/7—Axis handles 10,000+ FASTag calls monthly.

FASTag services for your car are like a glove, protecting you and keeping your journey hassle-free! Axis Bank is the following way is here to tailor it for different rides with prices and perks aplenty:

Price: ₹300 (₹100 tag cost + ₹200 refundable deposit)

Introduction: Sedans rule daily drives, and Axis FASTag keeps tolls seamless.

Description: Affordable RFID tech for instant payments—maintain ₹150 minimum. Sedans top the list at 40% of Axis FASTag users.

Price: ₹300 (₹100 tag cost + ₹200 refundable deposit)

Introduction: SUVs crave adventure, and Axis FASTag fuels the ride.

Description: Same cost, built for bigger trips—30% of users drive SUVs, per Axis data.

Price: ₹300 (₹100 tag cost + ₹200 refundable deposit)

Introduction: Zippy hatchbacks shine with Axis FASTag’s quick toll fixes.

Description: Compact and cost-effective—20% of users roll in hatchbacks.

Price: ₹300 (₹100 tag cost + ₹200 refundable deposit)

Introduction: Luxury rides deserve a premium FASTag experience.

Description: Sleek and stylish—5% of users enjoy this elite ease.

Price: ₹400 (₹100 tag cost + ₹300 refundable deposit)

Introduction: Workhorses get a FASTag built for heavy duty.

Description: Higher deposit, ₹200 minimum—5% of tags serve commercial needs.

You May Also Like --> Axis Bank FASTag Customer Care – Get Quick Support & Assistance

To experience a seamless journey, here are some simple yet important tips to keep in mind, and they are:

Recharge Smart: Use the app or UPI—80% of users top up online, says Axis.

Stay Ahead: Avoid the 10% blacklist risk from low funds (NHAI, 2024).

Go Digital: Email statements beat SMS clutter—sign up via the app.

Overall, why is Axis Bank FASTag winning the race? Well, all because it offers a 5-year tag lifespan, 24/7 support, and coverage across all toll plazas, it’s a driver’s dream. In 2024, Axis processed 50 million+ FASTag transactions, showing its muscle. The refundable deposit? That’s your freedom to switch gears anytime.

Also Read --> How to Recharge FASTag From Axis Bank App?

To summarise, it is clear how to check FASTag balance Axis Bank is no brain teaser as to be noted having an online Axis Bank FASTag is necessary. This government initiative saves time and money and makes life easier for travelers. That is because it takes less time to cross an Indian toll plaza, and there isn't as much traffic. If youn't have one, purchase an Axis Bank FASTag online to speed up your travels in India.