Paying income tax is a fundamental part of being a responsible citizen. The process can be cumbersome especially when it comes to paying the income tax challan. This guide aims to simplify the process for the financial year 2024-25.

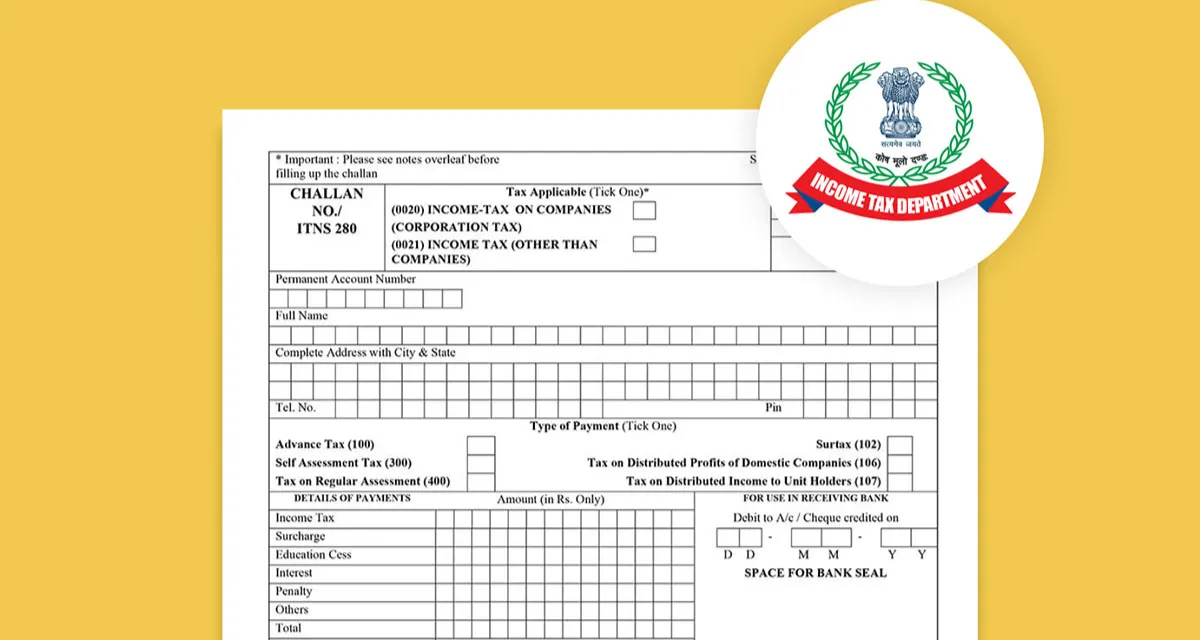

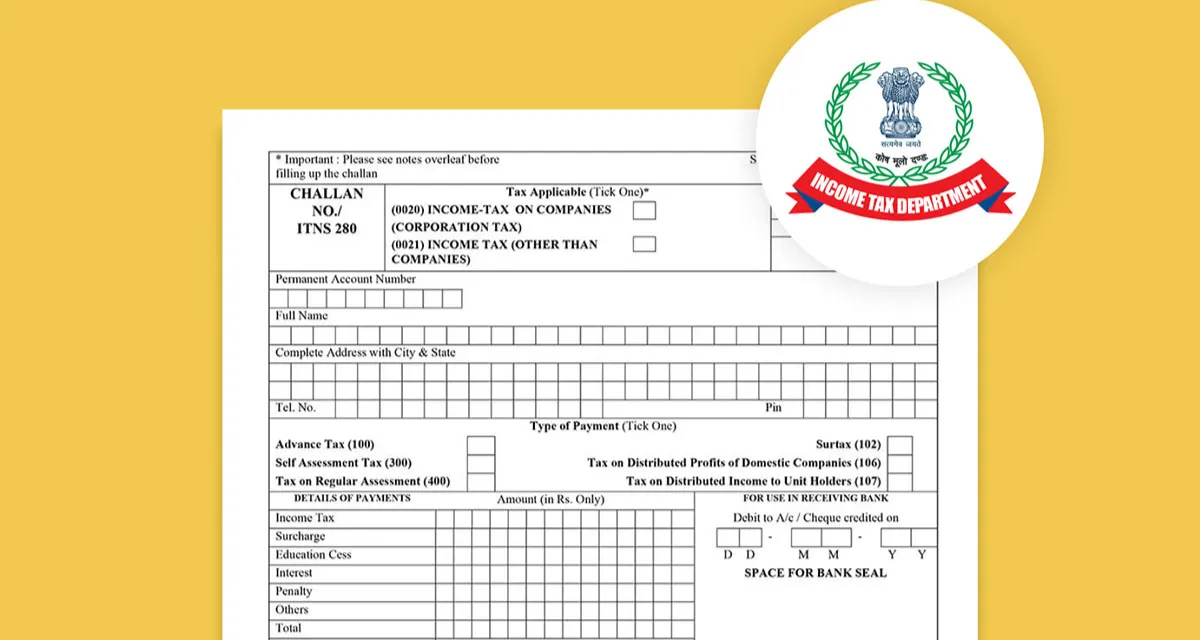

Income tax challans are official documents used for submitting income tax to government authorities. These documents are crucial for both individuals and businesses. By understanding this process, you ensure compliance with laws and avoid penalties.

There are various types of income tax challans used for different forms of tax payments. For instance, Challan 280 is utilized for regular assessments and advance tax. Challan 281 caters to deducting TDS from salaries and other payments. Knowing these challans is essential.

Step 1: Identify the Correct Challan

First and foremost, identify the appropriate challan form for your tax payment. Using the wrong form could lead to delays and complications. Ensure that you know which form applies to your situation.

Step 2: Enter Personal and Tax Details

After selecting the correct form fill in your personal information and tax details. This includes your name, PAN number assessment year, and type of payment. Accuracy is crucial to avoid errors.

Step 3: Choose the Mode of Payment

You have two options: online or offline payment. Online payment is easier. Visit the official income tax department website and navigate to the e-payment section. Offline payment can be done by visiting a designated bank.

Step 4: Make Payment

For online payments, follow the website’s instructions to complete the transaction. For offline visit a bank and submit the challan and the payment amount. Make sure you collect the receipt as proof of payment.

Step 5: Keep Records

After payment, it's essential to keep records of the transaction. Retain the challan copy and the receipt for future reference. This documentation is vital for audits or any tax-related queries.

Accuracy is pivotal when dealing with income tax challans. One common error is using an incorrect challan form. Another is entering the wrong assessment year or details. Double-checking this information can save time and prevent issues.

Paying your income tax challan is a critical responsibility. Following these steps can make the process straightforward. Avoid errors and complications. Being diligent and accurate ensures you comply with tax regulations. Stay organized and keep all records and receipts for easy reference.

Also Read: