The implementation of FASTag has simplified toll payments across India, providing a cashless and seamless experience for commuters. While most users know its functionality, the significance of a FASTag account statement often needs to be noticed.

This blog explores how to check FASTag statement, its benefits, and the various ways to access and download FASTag statements online, ensuring you stay informed about your toll expenses.

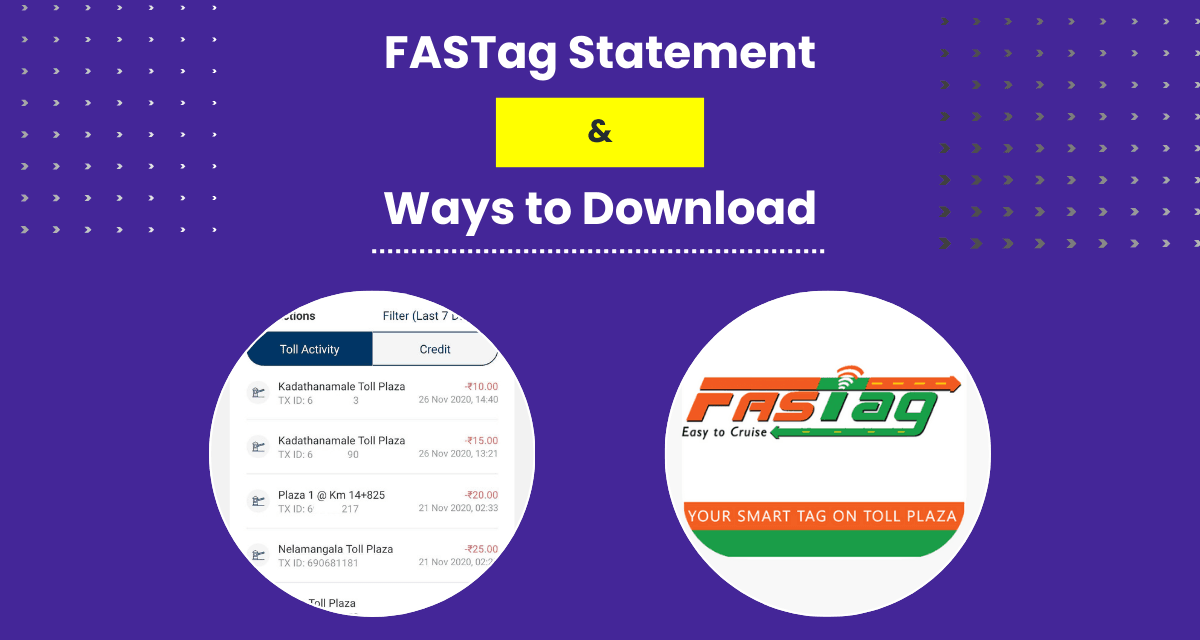

A FASTag statement is a detailed record of all toll transactions made using your FASTag. It includes information like toll plaza details, transaction time, amount deducted, and your vehicle’s registration number. This statement helps you track and manage your toll expenses easily and effectively.

Not only this, it includes vital information such as:

Toll Plaza Details: The name of the toll plaza where the payment was made.

Transaction Date & Time: When the transaction occurred.

Toll Amount: The exact amount deducted from your FASTag account.

Vehicle Details: Your vehicle’s registration number.

This statement serves as a consolidated record of all your toll payments, helping you track expenses effortlessly. Whether you’re using FASTag for personal or business purposes, regularly checking your FASTag account statement is essential for maintaining financial transparency.

FASTag is an innovative solution for cashless toll payments, designed to enhance convenience and reduce congestion at toll plazas. It uses RFID technology to automate toll collection, ensuring seamless transactions and eliminating the need for manual payments.

FASTag operates using Radio Frequency Identification (RFID) technology, facilitating automatic toll collection without requiring the vehicle to stop at toll plazas.

Here’s how it works:

Rechargeable Wallet: FASTag links to a prepaid account or wallet that can be easily recharged.

Automatic Scanning: As your vehicle crosses through a toll plaza, RFID sensors automatically scan the FASTag.

Cashless Deduction: The toll amount is deducted automatically from your linked FASTag account, removing the need of keeping cash or change.

Notifications: You receive a real-time SMS alert for each deduction, ensuring transparency.

FASTag payments are supported across all major highways and toll plazas in India. Linking your savings account, like HDFC Bank or ICICI Bank, to your FASTag makes toll payments even more efficient.

A FASTag statement is essential for tracking your toll expenses, ensuring accurate deductions, and maintaining a clear record of all transactions. It helps identify discrepancies and manage your account efficiently, offering transparency and better financial control.

The FASTag statement isn’t just a record of transactions—it offers several key benefits and they are:

Expense Tracking: FASTag statement helps you monitor toll expenses and plan your travel budget effectively by keeping a regular check on the expenses.

Transparency: By providing detailed transaction data, the statement ensures you’re charged the correct amount, helping you detect any discrepancies.

Convenience for Reimbursements: If you’re a business traveler or a fleet operator, a FASTag statement simplifies expense reimbursement or audits by providing a clear, detailed record.

Preventing Low Balance Issues: Reviewing your statement allows you to maintain a sufficient balance in your FASTag account, preventing issues during toll crossings.

Environmental Benefits: With a FASTag statement, there’s no need for paper toll receipts, reducing environmental impact.

You can easily check your FASTag statement online through various methods, such as:

NETC Portal: The official National Electronic Toll Collection platform.

Park+ App/Website: A convenient app for managing FASTag and other services.

FASTag Issuer: Banks or payment apps that provide FASTag services also offer platforms to view statements.

The NETC portal provides a centralized platform for checking your FASTag account statement. Follow these steps:

Visit the NETC Portal.

Log in using your registered credentials.

Navigate to the “Transaction History” section.

Enter the desired date range to view the statement.

Click "Submit" to access your statement.

Must Read --> How to Check FASTag History?

Park+ simplifies the process of managing your FASTag on your finger tips. Individuals can easily check their FASTag statement via the mobile app or website, depending on their preference and suitability.

Here's how:

Download and open the Park+ app.

Log in with your registered mobile number.

Navigate to the FASTag section.

Select the “Transaction History” option.

View your statement for a chosen period.

Visit the Park+ Website.

Log in with your registered mobile number or email ID.

Access the FASTag section from the dashboard.

Choose the time frame to view transactions.

Review or download your statement.

Each FASTag issuer, such as ICICI Bank, HDFC Bank, or Paytm, offers its platform to check your FASTag statement online.

Log in to your issuer’s app or website.

Go to the FASTag section in your profile.

Select the vehicle or account for which you need the statement.

Click on the “Transaction History” option.

Specify the date range and view your transactions.

Apart from using online portals, issuers provide additional ways to access your FASTag account statement. The other simple ways to get your FASTag statement are:

FASTag issuers send transaction alerts via SMS after every deduction. This acts as a mini-statement of recent activities.

Call your issuer’s customer care helpline of FASTag and request a detailed statement. Provide necessary details like your vehicle registration number and registered mobile number.

Downloading your FASTag statement offers a detailed overview of your toll transactions, providing clarity on deductions and ensuring account accuracy. It’s a handy way to monitor expenses, detect errors, and maintain a seamless travel experience.

Downloading and keeping a copy of your FASTag statement offers several advantages:

Offline Access: Once downloaded, you can review your statement anytime, even without an internet connection.

Error Detection: Detailed statements make it easier to identify discrepancies in toll deductions.

Ease of Reimbursement: Fleet operators and frequent travelers can use downloaded statements for reimbursements or financial audits.

Record Keeping: Having a saved copy ensures you have a record for future reference.

Downloading your statement via the NETC portal is simple. In order to get the FASTag statement offline, follow these simple steps listed below:

Log in to the NETC Portal.

Access the “Transaction History” section.

Select a date range and generate the statement.

Hit on the “Download” button to get the statement downloaded on your device.

FASTag provider like ICICI Bank and HDFC Bank allow users to download FASTag statements through their apps or websites.

Log in to the issuer’s app or portal.

Select the FASTag-linked account or vehicle.

Go to the “Account Statement” section.

Choose the desired date range.

Click the “Download” button to save the file.

You May Also Like --> How to Check FASTag Balance in PhonePe?

Staying on top of your FASTag expenses is easier with these tips:

Set Alerts: Enable SMS or email notifications for every deduction.

Regular Checks: Log in to your issuer’s platform at least once a month.

Use Apps: Leverage apps like Park+ for quick access.

Maintain Balance: Frequently review and top up your FASTag account.

Keep Records: Download statements monthly for personal or audit purposes.

Understanding and knowing how to download FASTag statement ensures you stay on top of your toll payments. Whether it’s for personal travel or managing a fleet, tracking your expenses through FASTag statements is crucial.

Also Read --> How to Close Paytm FASTag?

Opt for trusted names like ICICI Bank, HDFC Bank, and Paytm to ensure seamless toll payments, real-time tracking, and added perks. By leveraging the benefits of FASTag, you can make your travels more efficient, cost-effective, and environmentally friendly.